Independent Financial Advisor copyright for Beginners

Wiki Article

Investment Representative Fundamentals Explained

Table of ContentsAn Unbiased View of Ia Wealth ManagementInvestment Representative for BeginnersThings about Tax Planning copyrightThe smart Trick of Lighthouse Wealth Management That Nobody is DiscussingIndicators on Private Wealth Management copyright You Should KnowIa Wealth Management Fundamentals Explained

Heath can be an advice-only coordinator, this means the guy doesn’t manage their customers’ cash immediately, nor does he sell them specific lending options. Heath claims the benefit of this process to him is the fact that he doesn’t feel bound to provide some product to solve a client’s money problems. If an advisor is just prepared to offer an insurance-based solution to an issue, they may end steering somebody down an unproductive course into the name of hitting product sales quotas, according to him.“Most economic solutions people in copyright, because they’re compensated on the basis of the products they provide and sell, capable have reasons to advise one plan of action over another,” according to him.“I’ve picked this course of motion because I am able to have a look my personal clients to them rather than feel I’m using all of them by any means or trying to make a sales pitch.” Tale continues below ad FCAC notes the way you spend your own expert is based on this service membership they give.

Some Known Details About Independent Financial Advisor copyright

Heath with his ilk are compensated on a fee-only model, which means that they’re settled like legal counsel can be on a session-by-session foundation or a hourly consultation rate (independent financial advisor copyright). With respect to the number of solutions in addition to expertise or typical clientele of one's expert or coordinator, per hour charges can range for the hundreds or thousands, Heath saysThis could be up to $250,000 and above, according to him, which boxes around the majority of Canadian homes out of this standard of solution. Story continues below ad pertaining to anyone incapable of spend fees for advice-based strategies, and also for those reluctant to give up a percentage of the financial investment comes back or without adequate cash to get started with an advisor, you will find several cheaper and also complimentary options to take into consideration.

What Does Investment Consultant Do?

Tale goes on below advertisement choosing the best monetary planner is a little like internet dating, Heath says: you intend to get a hold of somebody who’s reputable, provides a character fit and is also best person your period of existence you are really in (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1706079058&direction=prev&page=last#lastPostAnchor). Some like their own advisors getting older with much more experience, he says, and others favor somebody younger who are able to hopefully stick to all of them from early years through retirement

10 Easy Facts About Independent Financial Advisor copyright Described

One of the biggest mistakes some one will make in selecting a specialist is not inquiring sufficient this article concerns, Heath states. He’s surprised when he hears from consumers that they’re anxious about inquiring concerns and probably appearing foolish a trend the guy locates is as common with founded experts and the elderly.“I’m surprised, because it’s their funds and they’re spending plenty fees to those individuals,” he states.“You need getting the questions you have answered therefore deserve to possess an open and truthful connection.” 6:11 economic planning all Heath’s final guidance is applicable whether you’re seeking outdoors monetary help or you’re going it alone: keep yourself well-informed.Listed here are four facts to consider and get yourself when learning whether you will want to touch the expertise of a financial advisor. The web well worth is not your earnings, but alternatively a quantity that can help you comprehend what cash you get, simply how much it will save you, and the place you spend cash, as well.

Getting My Investment Consultant To Work

Your child is on ways. Your own divorce case is actually pending. You’re nearing retirement. These along with other major existence activities may encourage the requirement to see with a financial consultant regarding your investments, debt objectives, along with other monetary issues. Let’s say your mom remaining you a tidy sum of money within her might.

You could have sketched out your very own financial program, but I have a difficult time staying with it. A monetary specialist can offer the liability that you need to put your economic anticipate track. In addition they may advise how to tweak the financial plan - https://lwccareers.lindsey.edu/profiles/4232859-carlos-pryce being maximize the possibility effects

Some Known Facts About Independent Financial Advisor copyright.

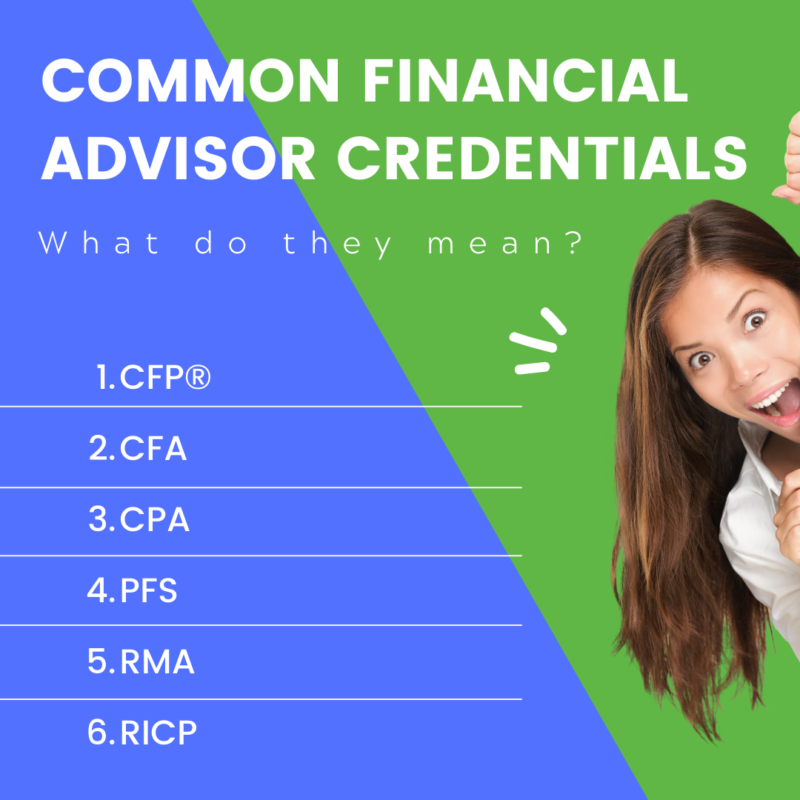

Anyone can say they’re an economic advisor, but a consultant with specialist designations is ideally usually the one you should employ. In 2021, approximately 330,300 People in the us worked as personal economic experts, according to the U.S. Bureau of work studies (BLS). Most economic experts are freelance, the bureau says - ia wealth management. Normally, you'll find five forms of financial experts

Brokers usually obtain commissions on positions they make. Brokers are managed of the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) and condition securities regulators. A registered expense advisor, either individuals or a company, is a lot like a registered agent. Both trade opportunities on the behalf of their customers.

Report this wiki page